The Crisp County Board of Education would like to provide you with accurate information regarding House Bill 581

Published 3:51 pm Tuesday, January 28, 2025

|

Getting your Trinity Audio player ready...

|

What is House Bill 581?

House Bill 581 was passed by the Georgia General Assembly during the 2024 legislative session and an enabling constitutional amendment (HR 1022) was subsequently approved through a statewide ballot question during the November 2024 election. Within HB 581, O.C.G.A. § 48-5-44.2 provides for a statewide floating homestead exemption which applies to counties, consolidated governments, municipalities, and local school districts. While the homestead exemption automatically applies to all local governments and school districts, the law includes a provision for these jurisdictions to opt out of the homestead exemption for their jurisdiction by following certain procedures by March 1, 2025.

Yes, HB 581 was passed by a majority of Ga voters (62.93%) in November 2024, however, the language of the amendment on the ballot explicitly stated:

“Shall the Constitution of Georgia be amended so as to authorize the General Assembly to provide by general law for a state-wide homestead exemption that serves to limit increases in the assessed value of homesteads, but which any county, consolidated government, municipality, or local school system may opt out of upon the completion of certain procedures?”

The language of the constitutional amendment clearly gives two options with “opting out” as a course of action; therefore, the Crisp County Board of Education is following the “will of the voters” in exercising the constitutional right to opt out authorized by the majority vote of House Resolution 1022.

HB581 has three major components:

- Grants a statewide homestead exemption that limits the increases in the taxable value of homes to no more than the inflation rate that occurred over the prior year;

- Allows local governments to elect to opt out of this homestead exemption within their jurisdiction so that it will not apply to their taxable values; and

- Authorizes most local governments with the new homestead exemption (or equivalent) to levy a new sales tax (FLOST-Floating Local Option Sales Tax) to be used for property tax relief.

*It is critical to note that this additional sales tax option (FLOST) is allowed only for county and city governments, not school districts. And a major reason why, 80% of school systems in Georgia have advertised an intent to opt out, including Sumter, Dougherty, Macon, Lee, Dooly, Irwin, Ben Hill, Worth, Marion, Turner, Peach, Houston, Taylor and Tift, among others.

What kind of homestead exemption is provided under House Bill 581? HB581 provides a floating exemption that adjusts each year to cover the difference between the original base-year value of a home and its current market value, ensuring the home’s taxable value does not increase. The base year value is adjusted annually by a percentage equal to either a set rate or the inflation rate that occurred during the prior year. This approach effectively “floats” to limit the assessed market value of a home each year, though the millage rate may still rise.

How does HB affect local school districts? School districts have only two locally controlled revenue streams, property taxes and ESPLOST (Education Special Purpose Local Option Sales Tax). ESPLOST funds are restricted in use by the voter approved referendum and cannot be used to pay for salaries and benefits.

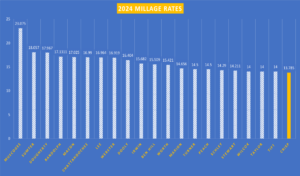

How much does property tax revenue generate for Crisp County Schools? CCSS receives approximately 19% of its total school funding from property taxes. By capping valuation increases to the previous year’s rate of inflation, this limits the amount of property tax revenue the school district receives unless the school district raises the millage rate. School districts can only raise the millage rate 2-mills at a time with a 20-mill cap. At 13.785 mills (2024 millage rate), CCSS continues to have one of the lowest millage rates in the surrounding area. Please note the chart below for comparison of millage rates to Crisp County Schools.

Will the QBE (Quality Basic Education) local five mill share contribution (LFMS) be impacted for CCSS?

The Local Five Mill Share (also referred to as LFS (Local Fair Share) will be impacted. It was originally thought it would be considered a state exemption but since there is an opt-out provision it will be treated as a local exemption. By treating it this way the LFMS will be calculated on the higher tax digest number which will directly impact the LFMS requirement for each school district. This creates a double hit on the inflation-impacted millage and the higher calculation of LFMS. LFMS is calculated on the gross tax digest requiring a higher local contribution to the state, yet property taxes will be collected on the lesser amount.

Will the QBE Equalization funding CCSS receives be impacted?

Yes, there will be impacts to the QBE Equalization funding. Equalization funding is based on the value of the district’s tax digest as compared to the entire state of Georgia’s property wealth. CCSS received $4,638,667 in equalization funds for FY2025.

What is the New Floating Local Option Sales Tax (FLOST)?

This new sales tax is created for the limited purpose of property tax relief. To be eligible to levy the tax, both the county and all cities within the county that levy a property tax must have in effect a floating homestead exemption: either the one created by this bill or a local floating homestead exemption.

*It is critical to note that it DOES NOT matter if the school boards opt out or not since they are ineligible to share in the proceeds of the tax. (Cited in the Association of County Commissioners of Georgia (ACCG) and the Georgia Municipal Association (GMA) joint training guidance and materials for HB 581.

Does the constitutional amendment include a provision for CCSS to impose a Floating (FLOST)?

No. Unlike for county and city governments, the constitutional amendment does not include a provision for school districts to impose a FLOST (Floating Local Option Sales Tax).

How does CCSS opt out of the HB581 homestead exemption?

CCSS must advertise and hold three public hearings of intent to opt out, pass a resolution opting out, and file the resolution with the Secretary of State. The process may not begin until January 1, 2025 and must be completed by March 1, 2025.

If CCSS opts out of HB581, will the local school tax homestead exemptions already in place be affected? No. Local school tax homestead exemptions will not be affected. It is important to note that a decision to opt-out would not affect any existing exemptions for Crisp County homeowners.

*During the first hearing held by the BOE on January 15, 2025 this was a very common misconception of HB 581 expressed by community members in attendance that BOE members were able to dispel.

Can the HB floating homestead exemption be repealed at a later date?

There are currently only 2 options for school districts: opt out by March 1, 2025, or accept the floating homestead exemption permanently. HB 581 requires a choice to be made by the current board as to whether to freeze forever the only source of local revenue available to the district for a sizable part of the tax digest or to opt out of the effect of the amendment.

How can local school districts compensate for the loss of funding?

School districts are particularly vulnerable under HB581, which caps property assessments but does nothing to limit the growth in the cost of providing essential services. Rural and low-income districts, which rely heavily on property tax revenues, will be particular affected. School districts like CCSS that have maintained a low millage rate will find it even harder to meet their financial needs. The funding gap could force districts to either cut services, reduce staff, or increase the school millage rate.

Our BOE has been through training on HB 581 and they have carefully weighed the pros and cons. Reducing staff is not a threat, but could easily become a reality with no means to replace the lost revenue generated through local property taxes. Our County and City Government is given the means to do that through a FLOST.

Crisp County School System plays a vital role in the overall vitality of our community, especially when we serve as the second largest employer in the county, with over 675 employees. Our monthly payroll is approximately 3.9 million dollars. The cost of providing State Health benefits to our classified employees is over 3 million a year that has to come from local funds, an amount not reimbursed by the state. Eighty six percent (86%) of our current budget is spent on salaries and benefits. Beyond providing education, Crisp County Schools is central to the local economy, offering jobs to a large segment of the population, from teachers to support staff, custodians, bus drivers, nutrition staff, maintenance staff and administrators. These jobs, in turn, support local businesses and services, creating a ripple effect throughout our community.

Advocating for public schools is about more than supporting a system—it’s about valuing the people who make that system work. It’s about recognizing that the strength of a community lies in its commitment to education, and when we uplift public schools, we uplift everyone working within them to ensure a brighter future for all.

Advocating for public schools is about more than supporting a system—it’s about valuing the people who make that system work. It’s about recognizing that the strength of a community lies in its commitment to education, and when we uplift public schools, we uplift everyone working within them to ensure a brighter future for all.