Avoiding additional costs to taxpayers

Published 11:44 am Friday, June 21, 2024

|

Getting your Trinity Audio player ready...

|

By Sarah Brown – Managing Editor

We recently spoke with the tax assessors’ office after noticing an increase on social media regarding an increase in property value and taxes. Now of course this can be a large concern for many people but we are here to tell you how they assess properties and how all of this is actually saving the taxpayers money although it may not seem like it.

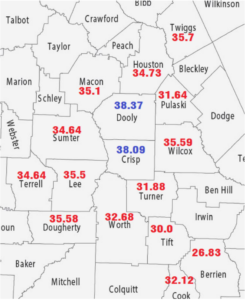

Procedures have been tightened from the Georgia Department of Audits and Accounts making the valuation process much more difficult for the assessors office. They are required to be within 36% and 44% assessed valued. Taxes are assessed at a 40% ratio. If they are within 38% to 42% they can assess public utilities at a 40% rate.

Trending

Example:

If they appraised a home for $80,000 and it sold for $100,000 that is a 32% ratio. They are required by law to be at least at a 36% of market value, which in this example would be $90,000 assessed value.

Sales ratio equation

80000 x 40%

100000

Ratios of 36% to 44% of assessed value equals 90% to 110% of market value (sales price)

Trending

From the most recent audited sales ratio report (2022), Crisp and Dooly county are the only two counties in our surrounding area that are within compliance of the 36% to 44% sales ratio. If this were not the case, they could be required to pay a penalty of at least $100,000 plus approximately $600,000 to have someone come in to consult and revaluate properties, along with a loss in public utility taxes. Which would end up costing the taxpayers more due to the inaccuracy, as this money would need to come from the taxpayers.

The assessors office is motivated to be as accurate as possible, but they are also here to help. They welcome homestead exemptions and specialized assessments that can save taxpayers money. They don’t claim to be perfect; they recommend reviewing your property and researching recent sales. It is also important to note that if someone appeals, the appraisers will come out and review your property for any changes that have occurred like renovations or any updates made.